By: Ankit Sood

Table of Content

- Banking market overview

- Challenges and threats to the banking industry

- Major challenges and threats the banking industry is facing

- Solutions for these challenges and threats

- Why SpendEdge?

- Success Stories: How we helped a leading banking service provider in the procurement of core banking software

- Conclusion

Banking market overview

The banking market plays a crucial role in the global economy, providing essential financial services that facilitate economic growth, stability, and development. The global banking sector is vast, with assets worth trillions of dollars. The sector continues to grow, driven by economic development, increasing financial inclusion, and technological advancements. However, growth rates and market sizes vary significantly across regions, with emerging markets often experiencing faster growth compared to developed economies.

In terms of key players, the banking market is dominated by commercial banks, which offer a broad range of services including deposits, loans, and payment services. Some of the largest commercial banks in the world include JPMorgan Chase, Bank of America, and HSBC. Investment banks, on the other hand, specialize in services such as underwriting, facilitating mergers and acquisitions, and providing advisory services. Prominent investment banks include Goldman Sachs and Morgan Stanley. Central banks play a critical regulatory role, overseeing the banking industry, controlling monetary policy, and ensuring financial stability. Notable examples of central banks are the Federal Reserve in the United States, the European Central Bank (ECB), and the Bank of Japan (BoJ).

In addition to these traditional players, the banking market is witnessing the rise of fintech companies and digital banks, which are leveraging technology to offer innovative financial services. These new entrants are challenging the conventional banking models, driving competition, and prompting traditional banks to adopt digital transformation strategies. Overall, the banking market is dynamic and continuously evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences.

Challenges and threats to the banking industry

Since the outbreak of the COVID-19 pandemic, the banking industry has been continuously faced with adversity in various forms, be it the highly dynamic regulatory landscape or critical cybersecurity concerns. With the increasingly fragile economy, exacerbated by other factors such as the Russia-Ukraine crisis, unprecedented supply chain disruptions, governments’ focus on tightening monetary policies, and rising inflation, the banking industry finds itself right in the line of fire. However, experts believe that banks that focus on diversification will be better positioned to wade through the innumerable uncertainties prevalent today and emerge relatively unscathed in the face of the biggest threats to banking industry. From a procurement perspective, controlling spend could well be the difference between success and failure.

Major challenges and threats the banking industry is facing

Warding off threats posed by the rapid rise of FinTechs

Besides being on the brink of a drastic shift already, the banking sector must also contend with intense competition from FinTechs, which appear to have taken the world by storm. Their swift and steady emergence has significantly changed the competitive landscape of the sector, driving traditional banking institutions to rethink their strategies entirely. Even new entrants in the FinTech industry have upped their game in a way that they can compete with banks right upon entering the market. This makes it imperative for institutions to carefully study the competitive landscape and even learn from their competition in order to tackle banking industry challenges and stay competitive.

Embracing technology in the midst of a momentous cultural shift

The importance or very presence of technology in even the most mundane of tasks we do in our daily lives cannot be understated, so one can only imagine how vital a role it plays with respect to our finances. Banks simply cannot afford to have manual, error-prone processes or systems any longer and must regroup to protect themselves against acute threats to the banking industry. Technology-based solutions are the way forward to stay ahead of the curve or to even keep one’s head above water and tackle various industry challenges. Banks must act fast and quickly promote a culture that values innovation and technology for their own profitability and to ensure customers are not left wanting.

Overcoming regulatory hurdles in a cost-effective manner

Since the catastrophic 2008 financial crisis, regulatory compliance has been one of the most daunting challenges in banking sector. The crisis also meant that compliance-related costs grew exponentially in relation to credit losses and earnings, leaving banking institutions scrambling to find ways to protect themselves against regulatory risk while ensuring cost reduction. Navigating the sheer vastness and complexity of the regulatory landscape puts enormous strain on resources and brings under scrutiny the ability of banks and credit unions to effectively handle data from various sources. To avoid incurring additional cost and risk, the industry must stay up to date with the latest regulatory changes and adopt relevant measures to meet requirements.

Putting up a strong resistance to inevitable security breaches

Being a predominantly service-oriented industry rather than a product-based one, banks often make the mistake of underestimating the criticality of supply chain operations. The use of third-party tools is on the rise, which in turn gives hackers plenty of opportunities to infiltrate systems easily with malicious codes and compromise the security of confidential data. The number of high-profile security breaches is shockingly high for a sector that demands the highest standards of security, which necessitates financial institutions to proactively identify threats and adopt technology-based solutions to protect confidential customer data and minimize the risk of financial and reputational losses.

Solutions for these challenges and threats

Surviving in a marketplace as competitive as this can be daunting in itself, let alone thriving. Banks must begin to fully reap the benefits offered by the latest technologies and embrace digital transformation to withstand the barrage of challenges prevalent today. Tackling the persistent threat posed by FinTechs requires banks and traditional financial institutions to actively look for partnership/acquisition opportunities at every turn. Refining outdated business processes and replacing irksome systems with those that dramatically increase convenience and ease of use for customers will be pivotal in determining how banks fare in the near future.

With the increasing acceptance of technology among customers (especially millennials and Gen Z) along with their fast-growing expertise in the same, banks find themselves at the precipice of a monumental industry transformation. Enhancing the ability to leverage disruptive technologies and innovations to drive process optimization as well as customer satisfaction must be the top priority for banks.

Why SpendEdge?

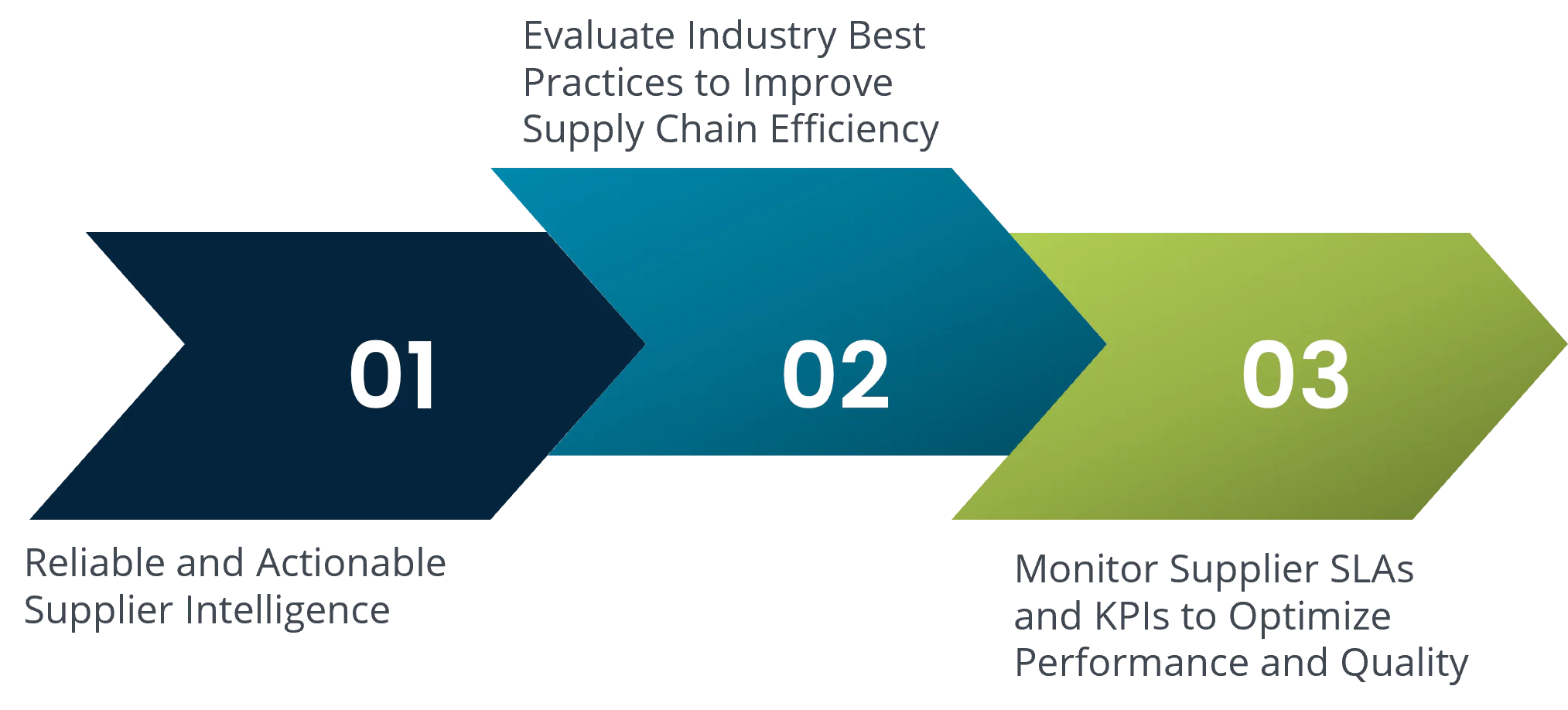

Reliable and Actionable Supplier Intelligence

Our team of experts can combine extensive domain knowledge with customized research methodologies to ensure that banking sector clients are provided with highly accurate supplier insights. Clients in the banking industry utilize our research solutions to effectively evaluate their suppliers and ensure smooth and timely delivery of services.

Evaluate Industry Best Practices to Improve Supply Chain Efficiency

Our seasoned experts support procurement teams by highlighting the best practices adopted by industry peers. This will help banks benchmark their operations and practices against those of the very best in the business and ensure that they’re on the right path. Having a clear understanding of these practices plays a crucial role in standardizing operations and reinforcing brand loyalty and trust among customers.

Monitor Supplier SLAs and KPIs to Optimize Performance and Quality

Keeping close tabs on suppliers with regards to quality and efficiency does not have to be an insurmountable endeavor for your procurement teams, especially when our experts are at your disposal. By leveraging our detailed insights into supplier KPIs, clients are better positioned to tackle any conflict well before they arise and take appropriate corrective measures.

Success Stories: How we helped a leading banking service provider in the procurement of core banking software

A reputable leader in the banking services industry was faced with procurement challenges in relation to core banking software. It also had a multitude of other requirements for which it was seeking reliable research solutions in order to equip its procurement team to take well-informed decisions and achieve the desired business outcomes. Furthermore, navigating the complexities of the regulatory landscape in the EU amid the Brexit scenario was proving to be burdensome.

Our experts carefully studied the intricacies of each requirement and proposed solutions and recommendations customized to suit the scope of the client’s business model. A comprehensive cost analysis of the core banking software under focus provided the client with valuable insights into the cost and benefits of implementation in terms of both short- and long-term scenarios. In addition, our team helped the client effectively tackle recruitment dilemmas with respect to physical security across its regions of operation, supported by accurate procurement intel. SpendEdge analysis also included a thorough study of the regulatory changes in the focus regions to empower the client to stay one step ahead and devise suitable mitigatory measures.

Talk to our experts now to find out how you can increase your preparedness to tackle the aforementioned challenges.

Conclusion

The banking industry is at a pivotal juncture, facing unprecedented challenges and opportunities. As technology continues to evolve, traditional banking institutions must adapt to stay relevant and competitive. The rise of fintech companies, shifting consumer expectations, and stringent regulatory environments necessitate a proactive approach to innovation and compliance. By leveraging advanced technologies and embracing digital transformation, banks can not only mitigate risks but also enhance operational efficiency and customer satisfaction. The insights provided by SpendEdge highlight the importance of robust supplier intelligence, industry best practices, and vigilant monitoring of supplier performance to optimize banking operations. The success stories demonstrate how tailored procurement strategies can effectively address specific challenges, ensuring sustainable growth and resilience in a rapidly changing landscape. As the industry navigates these complexities, a strategic focus on technology adoption, regulatory compliance, and supply chain efficiency will be crucial for banks to thrive and maintain their competitive edge.

Author’s Details

Ankit Sood

Vice President, Sourcing and Procurement Intelligence

Ankit is working as a procurement specialist at Infiniti Research and has vast experience in leading market and procurement intelligence request for clients ranging across industries such as BFSI, CPG, F&B, Chemicals, and Pharmaceutical. He helps clients in solving procurement challenges related to supplier and competitive intelligence, cost optimization strategies, and overall market understanding.