Cost-benefit analysis (CBA) is a strategic tool that empowers leading retail suppliers to refine their negotiation strategies with suppliers. In this article, we will explore how CBA enables these suppliers to systematically evaluate costs and benefits, identify cost outliers, and leverage data-driven insights for more effective negotiations. We will discuss the steps involved in conducting a CBA, including defining project goals, quantifying costs and benefits, and calculating key metrics such as net present value and benefit-cost ratios. By understanding these elements, retail suppliers can enhance their bargaining power, achieve significant cost reductions, and foster stronger supplier relationships.

Cost-Benefit Analysis: The Smart Way to Weigh Your Options

Cost-benefit analysis (CBA) is a systematic method used to evaluate the financial feasibility of a project or decision by comparing its expected costs and benefits. By quantifying both tangible and intangible elements in monetary terms, CBA helps organizations determine whether the potential rewards justify the investments required, guiding them toward informed decision-making. This analytical approach not only aids in assessing individual projects but also facilitates comparisons between multiple options, ensuring that resources are allocated effectively.

The Strategic Value of Retail Cost Analysis: Making Informed Decisions

Cost-benefit analysis (CBA) serves as a crucial tool for organizations to evaluate the economic feasibility of projects or decisions. Its primary purpose is to systematically compare the anticipated costs against the expected benefits, allowing decision-makers to ascertain whether an initiative is worthwhile. By quantifying both tangible and intangible factors in monetary terms, CBA provides a clear framework for assessing alternatives, ensuring that resources are allocated effectively and that investments yield maximum returns.

The key purposes of cost-benefit analysis include:

Evaluating the financial viability of a project or decision by comparing its expected costs and benefits

Quantifying tangible and intangible factors in monetary terms to facilitate decision-making

Providing a systematic approach to assess the economic feasibility of alternatives

Ensuring that resources are allocated efficiently and investments yield optimal returns

Guiding decision-makers toward informed choices by clearly highlighting the potential risks and rewards

Facilitating comparisons between multiple projects or decisions to identify the most advantageous option

By employing cost-benefit analysis, organizations can make well-informed choices, minimize financial risks, and maximize the potential for success in their endeavors.

When Should a Retail Business Conduct a Cost-Benefit Analysis?

Cost-benefit analysis (CBA) is a vital decision-making tool that helps businesses evaluate the financial implications of their choices. Here are key scenarios when conducting a CBA is particularly beneficial:

When considering significant financial commitments, such as purchasing new equipment or expanding facilities, a CBA helps assess whether the potential returns justify the costs involved.

Before launching a new project, businesses should conduct a CBA to determine if the expected benefits outweigh the costs, ensuring that resources are allocated effectively.

When faced with competing priorities for limited resources, a CBA provides a structured approach to evaluate which projects or initiatives offer the best value.

During the development of new business strategies, a CBA can help identify the most advantageous options by comparing potential outcomes against associated costs.

In situations where new regulations require changes to operations, a CBA can clarify whether the long-term benefits of compliance outweigh the initial costs of implementing necessary changes.

By employing cost-benefit analysis in these scenarios, businesses can make informed decisions that enhance their financial performance and strategic positioning.

Ready to make informed decisions that drive your retail business forward? Conduct a cost-benefit analysis with our expert guidance today and unlock the full potential of your investments—let’s turn insights into action!

Pros and Cons of a Retail Cost-Benefit Analysis

| Pros of Cost-Benefit Analysis | Cons of Cost-Benefit Analysis |

|---|---|

| Data-Driven Decision Making: CBA relies on quantifiable data, reducing reliance on gut feelings and biases. | Subjectivity in Valuation: Assigning monetary values to intangible factors can introduce ambiguity and personal bias. |

| Simplicity: It simplifies complex decisions by breaking them down into clear costs versus benefits. | Accuracy Challenges: Gathering accurate data and forecasting future costs and benefits can be difficult, potentially skewing results. |

| Uncovers Hidden Costs and Benefits: Prompts thorough examination of all potential costs and benefits, including indirect factors. | Limited Long-Term Applicability: CBA is often less accurate for long-term projects due to unpredictable variables like inflation and market changes. |

| Enhanced Resource Allocation: Helps prioritize investments by focusing on projects with the highest expected returns. | Over-Reliance Risk: Businesses may become too dependent on CBA, overlooking other qualitative factors that influence decisions. |

| Effective Risk Management: Identifies potential risks associated with decisions, aiding in better planning and implementation. | Removes Human Element: May overlook moral or ethical considerations that are not easily quantifiable but are important for decision-making. |

This table highlights the strengths and weaknesses of conducting a cost-benefit analysis, providing a clear overview for businesses considering this evaluation method.

The Step-by-Step Guide to Conducting a Winning Retail Cost Analysis

Cost-benefit analysis (CBA) is a powerful tool for evaluating the financial feasibility of projects and decisions. By systematically quantifying costs and benefits in monetary terms, CBA provides a data-driven framework for making informed choices that maximize returns on investments. Here’s a comprehensive guide to conducting a CBA that will give your organization a competitive edge:

1. Define the Project Goals and Scope

Begin by clearly defining the objectives of the project or decision you are analyzing. What are you trying to achieve? Establish the timeline and scope to focus the analysis.

2. Identify Costs and Benefits

Make two comprehensive lists – one for all the costs associated with the project, and another for the expected benefits. Consider both direct and indirect costs/benefits, including:

- Direct costs: materials, labor, equipment, etc.

- Indirect costs: overhead, training, lost productivity, etc.

- Direct benefits: increased revenue, cost savings, etc.

- Indirect benefits: improved efficiency, brand reputation, etc.

3. Assign Monetary Values

Quantify each cost and benefit in monetary terms. For direct costs and benefits, this is straightforward. For indirect and intangible factors, use estimates, market data, or willingness-to-pay calculations.

4. Calculate Net Present Value (NPV)

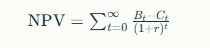

Discount future costs and benefits to their present value using an appropriate discount rate. This accounts for the time value of money. The formula is:

Where:

- $B_t$ = Benefits in year t

- $C_t$ = Costs in year t

- $r$ = Discount rate

5. Calculate the Benefit-Cost Ratio (BCR)

The BCR is the ratio of total discounted benefits to total discounted costs. It indicates the amount of benefit per dollar of cost:

BCR=Total Discounted Benefits/Total Discounted Costs

A BCR greater than 1 means the benefits outweigh the costs. The higher the BCR, the more favorable the project.

6. Perform Sensitivity Analysis

Test the robustness of the results by varying key assumptions like discount rates, cost estimates, and benefit projections. See how sensitive the BCR is to changes in these variables.

7. Make a Decision

Based on the NPV and BCR, decide whether to proceed with the project. If the NPV is positive and the BCR exceeds 1, the project is financially viable. Compare BCRs across alternative projects to prioritize the best options.

By following this step-by-step guide, you can conduct a winning cost-benefit analysis that provides a clear roadmap for making strategic decisions that drive your organization’s success.

Retail Cost Analysis in Action: Real-World Success Stories That Drive Profitability

| Retailer | Cost Analysis Focus | Findings | Outcome |

|---|---|---|---|

| Walmart | Price Optimization | Analyzed competitor prices and adjusted their own prices accordingly. | Increased sales and maintained market share. |

| Starbucks | Product Bundling | Implemented price bundling for coffee and pastries to enhance perceived value. | Boosted customer purchases and loyalty. |

| Gap | Localized Pricing | Used data to optimize inventory pricing based on location and distribution costs. | Improved delivery efficiency and reduced costs. |

| Target | Dynamic Pricing | Monitored real-time sales data to adjust prices based on demand fluctuations. | Maximized profitability during peak seasons. |

| Best Buy | Competitive Pricing Analysis | Reviewed competitor pricing strategies to set competitive prices for electronics. | Enhanced market competitiveness and sales growth. |

This table illustrates how various retailers conduct cost analysis to optimize pricing strategies, improve sales, and enhance overall profitability.

Unlocking Cost Savings: Why SpendEdge is Your Go-To Partner for Retail Cost Analysis

Choosing SpendEdge for retail cost analysis offers several compelling advantages that can significantly enhance your business’s procurement and negotiation strategies. With its advanced analytics and should cost modeling, SpendEdge empowers organizations to gain deep insights into cost structures, enabling them to negotiate effectively with suppliers and optimize their supply chains.

Their approach not only identifies cost-saving opportunities but also enhances supplier relationship management, fostering long-term partnerships. By leveraging SpendEdge’s expertise, businesses can make informed, data-driven decisions that drive profitability and ensure a competitive edge in the retail market.

Unlocking cost savings in your retail operations is just a step away. Let’s elevate your business to new heights together-to transform your procurement strategies and drive significant savings,

Conclusion

Cost-benefit analysis (CBA) is a vital tool for leading retail suppliers to enhance their negotiation strategies. By systematically evaluating costs and benefits associated with supplier relationships, businesses can identify key cost drivers and potential savings. This data-driven approach empowers procurement teams to negotiate more favorable terms, ultimately leading to significant cost reductions while maintaining strong supplier partnerships. CBA provides a clear framework for decision-making, enhancing the supplier’s bargaining power and contributing to long-term financial sustainability. In essence, leveraging CBA enables retail suppliers to develop effective negotiation strategies that foster competitive advantage in the marketplace.