Key Takeaways

- Green entrepreneurship is crucial for reducing pollutant emissions and promoting environmentally friendly companies.

- Effective use of strategy and technology can enhance economic stability and social stability through sustainable practices.

- Focusing on recyclable materials and optimizing energy consumption is vital for addressing climate change and improving living conditions.

- The transformation towards a sustainable way of life is essential for the planet’s well-being and future growth.

A little less than a quarter of all energy consumed in the world in 2022 came from renewable energy sources (e.g., hydropower, traditional biomass, biofuels like ethanol and biodiesel, wind, solar, and geothermal energy). Hydropower led the renewables pack (6%), followed by traditional biomass and modern biofuels (7%), wind (3%), and solar (2%). Nuclear power held a 4% share of the global energy circuit. Fossil fuels (oil, coal, and natural gas, in that order) dominated the global energy landscape with a formidable 76% share. That said, the share of fossil fuels is likely approaching a plateau, starting 2025, with renewables expected to reach 30-35% of the global power generation mix in the next 2-3 years. Moreover, there are strong signs of a shift toward renewables. In 2022, for the first time, solar and wind surpassed gas in Europe’s electricity mix, meeting a fifth of the continent’s power requirements. For global economies to transition to the 2050 “net zero scenario,” in which CO2 emission reductions balance out actual emissions, it is important to crank up renewable energy production by 11-12%, year on year, all the way up to 2030.

Copper, nickel, manganese, cobalt, chromium, molybdenum, zinc, rare earths, and silicon are some of the most sought-after metals for use in renewable/clean power generation infrastructure (such as wind turbines, solar photovoltaics, and nuclear reactors), storage (battery), and end-use equipment. Other industries are also competing for all these renewable energy metals. For instance, sectors like construction, electronic goods, and material-handling equipment have a huge appetite for copper. The metal is also used in solar heat exchangers and PV wires and cables, besides thermal heating and cooling systems. Within the solar industry, CSPs, in particular, make use of nickel-containing alloys. Off-grid solar power storage batteries contain nickel, cobalt, and lithium. Aerospace, oil and gas, chemical process, and automotive are major end user industries for nickel alloys. Though the largest end use for cobalt is in batteries and EVs (77%), the metal is also critical to the production of industrial metals, industrial chemicals, and high-performance alloys.

Australia, Chile, and China account for more than 90% of global lithium output. Four of the largest lithium mines in the world are in Australia. The rest are dispersed across Chile, Argentina, Zimbabwe, and Bolivia. DRC has more than a lion’s share of cobalt mines! Eight of the top ten cobalt mines by production are in the sub-Saharan African nation. Indonesia, Philippines, New Caledonia, Russia, and Australia are the world’s leading nickel producers. Chile is the biggest copper producer (and home to two of the largest mines), followed by Peru, China, DRC, USA, Australia, and Russia.

What is the green transition?

The green transition is the time required to execute the changes that will lead societies to realize a feasible way of life and so that human action not endangers the planet. The critical thing, or at slightest the foremost vital, will be to decide accurately what methodologies and activities ought to be conducted amid the period considered as the restrain in arrange not to reach a point of no return.

Green entrepreneurship: Is it possible?

Eco-conscious entrepreneurship is not only possible; it is practically mandatory these days. Authorities are offering numerous aids to pave the way for environmentally friendly companies and businesses, and the transformation of existing ones.

Entrepreneurship experts have identified five aspects that every company must take into account in order to start a business sustainably. They can be summarized as follows:

- Control and reduction of energy consumption and work materials.

- Optimization of road journeys.

- Use of recyclable materials.

- Implementation of technologies for optimal use of natural resources.

- Responsible control and treatment of waste.

These five principles do not necessarily require major changes in companies. For example, keeping heating and air-conditioning temperatures at average values, using LED bulbs, or creating sustainable mobility programs through fleet management. All this can be done thanks to the connectivity of the Internet of Things (IoT).

Environmental awareness is becoming increasingly important across key industries, shaping the future of economic activity. Companies adopting a sustainable way of life contribute positively to the planet, addressing climate change and extreme weather events that impact living conditions. Reducing pollutant emissions through green entrepreneurship is crucial for maintaining a healthy environment. By integrating strategy and technology, businesses can enhance their sustainability efforts and ensure a better future for all.

Market developments related to renewable energy metals

All about the race for copper, nickel, cobalt, and lithium

Copper is probably the best conductor of electricity if we leave out silver, which is nearly 100% costlier! Copper is also very pliable, and, more importantly, 100% recyclable. So, copper has seen huge take-up as a key component of solar, hydro, thermal, and wind energy systems, besides electric vehicles (EVs). Condensers, heat exchangers, pumps, piping, EVs, battery storage, concentrating solar power (CSP) plants, as well as turbines in geothermal, hydro and wind power make use of nickel-containing alloys and coatings to varying extents. Another highly requested metal in energy transition is cobalt, more than a third of which goes into EV batteries. The hard, shiny, highly durable metal is also a key component of the permanent magnets in wind turbines while some of its compounds are known to enhance the anaerobic digestion of organic matter into biogas. Given that renewable energy systems are mostly intermittent, these cannot do without battery storage, and this is where lithium finds the most usage (80%). Among other critical metals in strategic energy technologies, aluminum is commonly used in PV frames and panels as well as tower platforms and turbines in wind power projects. Zinc, for its part, has already proved its mettle as a corrosion-protective agent in solar panels.

A case of demand racing past supply

In the race toward green transition, copper consumption might soar by up to a third. The red metal might just be a victim of its own success. Aluminum is billed as a low-cost alternative and it also happens to be more abundant and lighter, which makes up for its 60% lower conductivity. Its inherent strength, resilience, and malleability make nickel the right candidate for use in renewable energy generation systems. Demand for minerals like nickel and cobalt is projected to skyrocket 65-70% by 2040 as economies get up to speed on renewables generation. Titanium and iron-chromium-aluminum alloy are also being mooted as nickel substitutes. This year, soaring supplies from the Democratic Republic of Congo (DRC), which produces 7 out of every 10 tons of battery material cobalt, is projected to create a small surplus of around 5,000 tons. A majority of EVs and plug-in hybrid electric vehicles (PHEVs) run lithium-ion batteries, and a typical EV battery pack contains 8 kilos of lithium! Is it any wonder that the demand for lithium batteries will soar at least 5x by 2030 from current levels? Lithium output has increased over the years, and annual production is forecast to be in the range of 1.5 million tons by the end of this decade. With global EV sales growing by leaps and bounds to exceed 30 million vehicles by 2030, demand for the renewable energy metal, nicknamed “21st century oil” will likely exceed supply by a factor of 2! Magnesium material is considered a viable alternative to lithium and might provide twice as much power at a lower cost. Sodium is often tipped to replace lithium-ion batteries, but the batteries might just turn out to be heavier and less powerful. At the same time, replacing graphite in lithium batteries with silicon might help lithium batteries last longer. Another aspirant to the throne of Lithium in batteries is Zinc. Zinc-ion batteries hold the promise of being a stabler and longer-lasting alternative to their lithium-ion counterparts.

The irony of it all: Environmental and social risks posed by clean energy drivers!

Arguably, copper, key among green energy metals, is a big pillar of strength for the up-and-coming renewable energy infrastructure, but ironically enough, extraction of metals used in renewable energy, not limited to copper, is polluting ambient water and air. Excessive exposure to copper is a leading cause of skin, eye, and lung conditions. Ill-planned expansion of copper mines is reportedly displacing indigenous communities in south-western New Mexico. Calls that automakers and electronics companies work with more environmentally sensitive suppliers in Chile, Peru, and the DRC, the world’s leading copper producers, are growing shriller. An open-pit copper mine, nearly two kilometers in diameter, cannot be a reality without significant degradation of forests, which pushes thousands of wildlife species to the brink of extinction. Indonesia tops nickel production, and piping of contaminated nickel waste (deep-sea tailings disposal) is leading to serious environmental effects and depletion of fish around Obi Island. More than half of all lithium production happens in emerging economies with weak labor codes and environmental mandates. Meanwhile, large parts of the Congo basin, home to one of only three remaining largest tropical rainforests, have been denuded to make way for giant cobalt mining businesses. Spinal column and limb abnormalities at birth and lung conditions have been linked to heavy cobalt concentrations in the air, water bodies, crops, and fish in the region. DRC figures among the five poorest nations in the world, and grinding poverty is reportedly driving child labor in several of the country’s cobalt mines. Air, water, and soil contamination as well as water depletion, health hazards, and displacement of local cultures and fauna are some of the documented effects of lithium mining. Powerful politicians, bureaucrats, and local warlords in strife-torn locations wield considerable discretionary powers in the allotment of mining rights to transnational corporates, so predictably corruption and bribery are endemic to the extraction industry, especially in the poorer global south. The time for renewable mining is here and now! Embracing “green mines green energy” is a bare necessity that humankind can’t overlook without imperiling itself.

Moving metal prices amid global headwinds

Rising global production has sent nickel prices plummeting from a high of $1,00,000 a ton in March 2022 to around $30,000 in January 2023. Supplies of another of these new energy metals, copper, might consistently tighten amid growing demand. Talking of nickel, the good part, at least for now, is that the metal’s production surpassed demand by 112,000 tons in 2022! However, the problem of single-source risk can’t be overlooked. Indonesia continues its reign as the world’s nickel powerhouse, with nearly half the global market under its belt! Robust EV sales in early May 2023 lifted battery-grade lithium prices to $26,380 a ton, though the figure is still shy of the November 2022 high of $28,000 per ton. Swamped by supplies from key producer DRC, prices in the battery cobalt market might dampen by $9,000-13,000 a ton between now and 2024. Last year, the metal traded at around $64,000 per ton. Amid lowered copper uptake in China, its major importer, prices of the metal fell to $7,867 per ton, the lowest since late November 2022. China consumes up to three-fifths of all zinc metal inventory, and in a tepid Chinese market Zinc prices stood at $2,300 a ton, a far cry from $3,462 it hit in January 2023.

How SpendEdge can help with Green Energy Transition

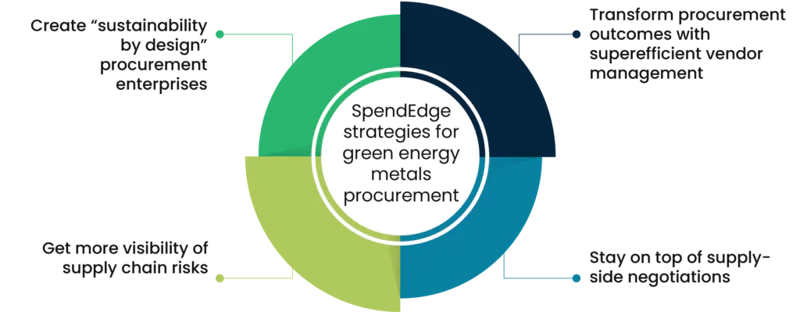

Transform procurement outcomes with superefficient vendor management

At SpendEdge, we help businesses, including in the renewables sector, run effective vendor management practices, including for procuring critical metals in strategic energy technologies. This means our clients can thrive in a hyperdynamic marketplace, no matter what. With timely assistance from our procurement intelligence experts, businesses have succeeded in not only choosing smart vendors but also setting expectations with laser precision to ride out risks and generate appreciable bottom-line results.

Stay on top of supply-side negotiations

Being in charge of the vendor negotiation process is top of the wish list for many procurement organizations. By putting data on cost, quality, speed-to-market, supplier relationships and, of course, the product itself (e.g., green minerals) at the heart of the negotiation process, our experts fulfill the client’s wish to have more control over contract negotiations.

Get more visibility of supply chain risks

Businesses that have taken care to integrate their supply chain more tightly are more successful in preempting and containing logistics risks than those that haven’t. That’s because the former benefit from more unified views of supply-side risks from across touchpoints. Our expertise has enabled large, medium, and small businesses to prioritize the most damaging risks and focus resources on them before they can upend critical operations.

Create “sustainability by design” procurement enterprises

There is mounting pressure on mining businesses to “clean up their act” and be more accountable. From local communities and rights groups to regulators and law makers, stakeholders are turning up the heat on extraction businesses. Mindful of the fact that the only future for industrial procurement is one that embeds sustainability every step of the way, our experts provide clients with the lowdown on the sustainability initiatives of competitors. Furthermore, with our expertise, businesses can work out the cost implications of sustainable operations and pick the best-fit route to a sustainable future for their procurement organization.

Success Story: A green energy player ups negotiation stakes, reins in key procurement cost drivers

Our client is a leading manufacturer of green energy components based in the US. The pandemic slammed the brakes on key raw material supplies, including various green energy materials, threatened to push up price points, in turn, leading to potential shopfloor disruptions and revenue shortfalls. Even post the pandemic, the supply chain activities were limping back to normalcy, so the client wanted to accurately assess price trends for its business segment based on multiple factors like past behavior, pandemic-induced economic shocks, as well as end user demand and sentiment. In early spring 2022, the client began to work with our experts after a thorough due diligence.

With a view to identifying supply chain segments that are in dire need of improved visibility, forecasting accuracy, route optimization, and stakeholder collaboration, our experts meticulously went over every stage of the client’s supply chain. This was an end-to-end effort, straddling key phases of the interconnected supply chain journey, from green minerals mining, storage, and transport to shipping finished components to end customers. By carrying out a rigorous and in-depth supply-side analysis, our specialists were able to pin down inefficiencies weighing down the client’s complex logistics system. Our team then proceeded to discover alternative supply sources to bridge the gap between what the client needed and what it was currently getting. In a little while, our specialists arrived at a short list of alternative vendors, evaluated for key performance and sustainability measures like quality, financial stability, slavery, and child labor risks, as well as various environmental and social practices. A benchmarking of the client’s vendor billing rates was also conducted to ensure the client was getting value for money vis-à-vis the competition and to recognize the key price drivers in vendor ecosystems. With detailed cost benchmarking data, the client now enjoys more headroom in vendor negotiations. That’s not all. Our experts also delivered the SpendEdge proprietary commodity outlook for critical base raw materials and corresponding inflation indicators for sub-components.

Based on our comprehensive spend market intelligence, the client has floated an RFx with the shortlisted alternative supply sources for critical metals in strategic energy technologies. Backed by adequate data on the pricing outlook and inflation for commodities and downstream sub-components, the client’s category managers are well-placed to make the first move at the negotiation table to produce a distinct bargaining advantage. With the right set of circumstances around it, the client’s procurement organization looks ahead to reduce costs, rejuvenate supplier relationships, and realize appreciable bottom-line results in the short-to-medium term.

Contact us now to solve your procurement problems!

Conclusion

Adopting green entrepreneurship is essential for a sustainable way of life that ensures the planet’s well-being. By integrating effective strategy and technology, businesses can significantly contribute to reducing pollutant emissions, optimizing energy consumption, and utilizing recyclable materials. This not only aids in addressing climate change and extreme weather events but also enhances living conditions. Transitioning to environmentally friendly companies is crucial for the transformation towards sustainable economic stability and social stability, ensuring growth and a healthier environment for future generations. Prioritizing natural resources and their optimal use will pave the way for long-term planet sustainability.

Author’s Details

Vinodh Kumar Kshathriya

Associate Vice President, Sourcing and Procurement Intelligence

Vinodh manages a research team within Infiniti Research, working closely with some of the largest (Fortune 500 included) clients from the pharma, energy, F&B, and defence sectors. With a total of 16 years of experience in research and client services, he has majorly worked on solving business queries through various analysis including market, financial, risk, costing, etc.