By: Arthi

Table of content

- Introduction to construction procurement

- Why “construction time management” is money?

- Budgeting as the centrepiece of construction procurement

- The criticality of contracting with the right supplier

- Types of construction procurement

- How can the procurement process benefit the construction industry?

- Challenges in procuring construction services

- How SpendEdge can help BFSI companies

- Success story: A procurement organization in the US steel industry improves budgeting and forecasting accuracy

Introduction to construction procurement

The prevailing mood in global construction is one of cautious optimism. Federal highway programs in the US worth nearly $350 billion, plus various other public infrastructure projects worldwide, are certainly grounds for hope and confidence in the future of the industry. Even so, a total rebound for the industry might be too much to ask. The reasons are many, including continued supply-side bottlenecks and rising input costs. Besides, to keep the show running, the sector must top up the workforce by half a million at least just in the US this year. In the interim, the industry needs to get by with available resources and, while at that, businesses must welcome resource-saving practices with open arms to avoid costly project delays and heavy penalties. Essentially, there is a dire need to rethink what is construction procurement. Effective time management practices and cost-estimation techniques are key steps in this direction. Construction procurement must also consider getting more granular on supplier selection criteria to make the most of their available materials and staff.

Why “construction time management” is money?

The risks associated with delayed project completion are many and more than what meets the eye. Of course, costs would go up, where a project is stuck in delays, and overshoot the budget outlay in some of the worst cases. After all, labor accounts for about three-fifths of all construction costs, and every additional day of work means an increase in wage bills.

Procurement organizations might be liable to refund pre-payments to buyers with interest, depending on the booking agreement if a project is delayed beyond the expected tenure. Investors in construction projects would reasonably expect the real estate developer to resolve delays within a foreseeable and justifiable timeframe. Else, the developer’s brand credibility and equity might take a serious hit. Organizations keen on construction procurement also risk getting bogged down in long-drawn litigations.

Budgeting as the centrepiece of construction procurement

- Stakeholders would naturally expect construction projects to be brought to closure in time with high quality and within a pre-defined budget.

- Apart from weighing up various expenses, a project will incur (e.g., labor, equipment, materials, overheads), project managers in construction procurement must make fine adjustments to the initial financial plan based on actual performance.

- Less-than-optimal budgeting often delays infrastructure projects beyond the projected completion time and exceeding the planned cost.

- Looking at budgetary planning as some kind of thoughtless and routine drill could have serious business outcomes – none of which is likely to be positive – for construction procurement.

The criticality of contracting with the right supplier

Specific tasks and services are farmed out to contractors in infrastructure projects of all sizes and flavors (e.g., greenfield development, brownfield sites, public facilities and the like) to get things done fast.

Selecting contractors who can ensure quality work and a worksite that is free of injuries and afflictions is crucial to the success of any construction procurement project. The minimum baseline is that contractors should have demonstrated proficiency in delivering complex projects. Over and above that, contractors must equip workers to carry out their tasks not just cost-effectively but safely as well.

Fatal and non-fatal injuries at work sites in the US translate to more than $200 billion in annualized healthcare costs, productivity loss, and compensation coverage for occupational injuries and ailments. So, it is important for businesses to onboard contractors with proven commitment to upholding standards around health, safety, environment, worker rights, and governance.

Types of construction procurement

1. Traditional procurement:

The client chooses a contractor and negotiates a contract. The contractor is then responsible for finding and managing the materials and suppliers needed to finish the project. This type of procurement is appropriate for smaller projects with low risk and limited complexity.

2. Design-bid-build procurement:

The client selects a designer to create the plans for the project. The designer then requests bids from contractors to complete the project. The client then picks the contractor with the lowest bid to finish the project. This type of procurement is suitable for larger projects with a longer timeline.

3. Design-build procurement:

The client contracts with a single design-build firm to complete the entire project. The firm is responsible for both designing and building the project. This type of procurement is suitable for projects with a tight timeline or limited budget.

4. Construction management procurement:

A construction manager is hired to oversee the project. The construction manager is responsible for managing the project, selecting subcontractors, and controlling the budget. This type of procurement is suitable for complex projects with multiple contractors and different phases.

How can the procurement process benefit the construction industry?

- The construction procurement process is essential for the success of construction projects, offering numerous benefits that enhance efficiency and outcomes.

- One of the primary advantages is cost savings; effective procurement strategies help secure materials and services at competitive prices, reducing overall project expenses through favorable terms and bulk purchasing.

- Procurement ensures quality control by sourcing only high-quality materials and services, maintaining the project’s integrity and standards, and preventing costly rework or repairs.

- Another significant benefit is risk management. A well-defined procurement process incorporates strategies to mitigate potential issues like delays, cost overruns, and supply chain disruptions, ensuring that risks are identified and addressed early.

- Adhering to procurement timelines is also crucial for the smooth progression of construction projects. Proper scheduling and coordination ensure that materials and subcontractors are available when needed, preventing delays and keeping the project on track.

- The procurement process also helps navigate legal and regulatory requirements, ensuring compliance with industry standards and avoiding legal complications.

- Procurement management plays a vital role in aligning procurement activities with the overall project management plan, including developing a detailed procurement schedule. Various procurement models, such as the Construction Management model, offer flexibility and adaptability to meet specific project needs.

- Effective procurement strategies foster strong supplier relationships, which are crucial for reliable supply chains and timely delivery of materials. This collaboration is particularly important in addressing construction industry challenges, such as fluctuating material costs and labor shortages.

Challenges in procuring construction services

1. Time management:

Effectively managing the timeline is essential in construction procurement. Ensuring that the project is completed on schedule can be difficult if the client lacks the necessary resources or expertise to oversee the process.

2. Budgeting:

Successfully managing the budget is crucial in construction procurement. Ensuring that the project is completed within the allotted budget can be a challenge for clients without prior experience in budgeting and cost estimation.

3. Selecting contractors:

Choosing the right contractors is paramount for successful construction procurement. Clients may struggle to evaluate and select the most suitable contractor if they lack experience in this area.

4. Managing relationships:

In construction procurement, effectively managing relationships with multiple contractors and suppliers is essential. This can once again pose a challenge for less experienced client

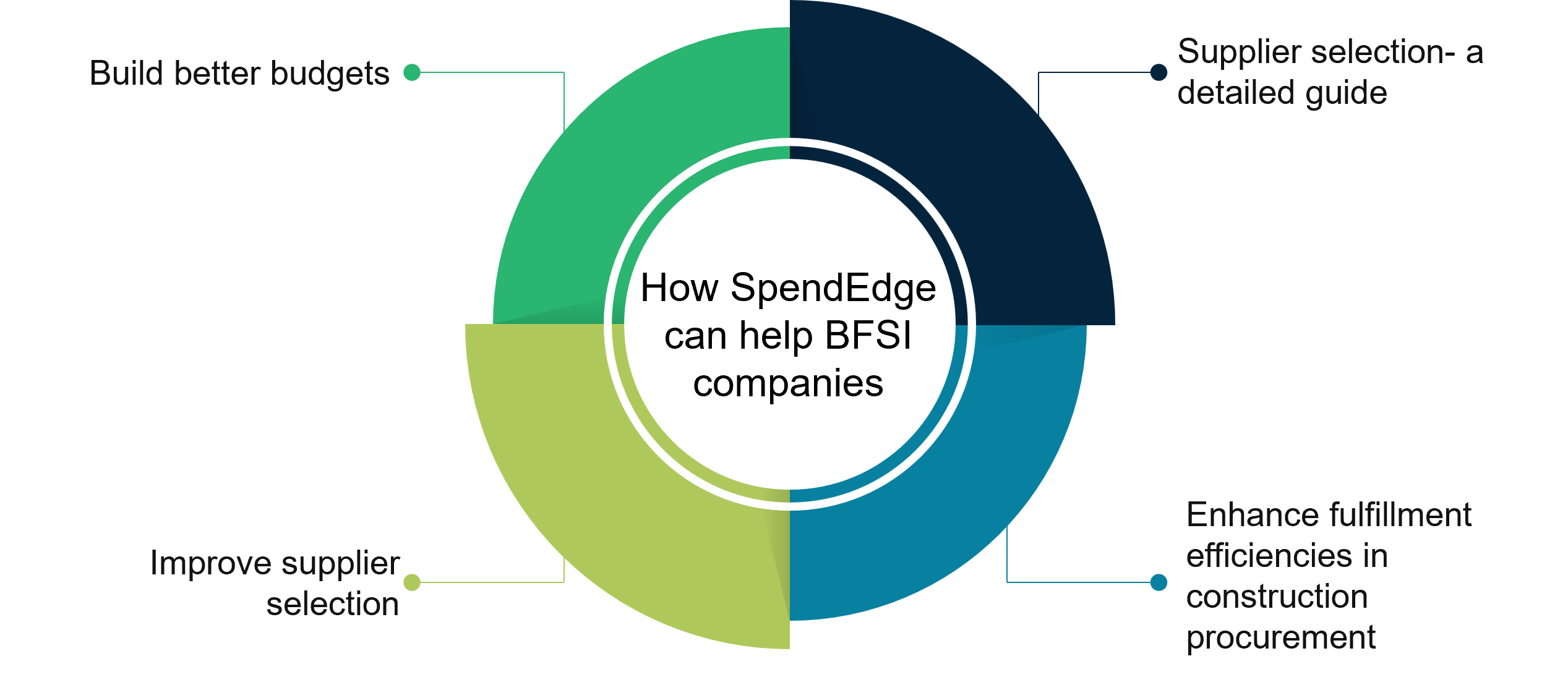

How SpendEdge can help BFSI companies

1. Build better budgets

In budgeting, procurement holds a significant role in managing spending. However, it’s often overlooked when drafting financial plans. This oversight can lead to inaccuracies in budgets and hinder the effective execution of financial strategies. Integrating construction procurement into the planning process is crucial for ensuring budget precision and maximizing the impact of financial plans. At SpendEdge, our team of procurement experts specializes in refining construction procurement methods and ensuring seamless plan execution to optimize project outcomes. In collaboration with construction industry pros and the procurement team, we streamline construction project costs and implement efficient methods of procurement tailored to project needs. Our expertise spans the entire construction procurement process, from sourcing suppliers to negotiating construction contracts. Leveraging cutting-edge procurement technology, we enhance the efficiency and transparency of construction project procurement. With a focus on delivering comprehensive construction solutions, we facilitate smoother construction management by empowering procurement managers to develop and execute a Strategic Procurement Plan aligned with project objectives. By integrating construction procurement into budgeting processes, businesses can achieve greater accuracy in financial planning and drive impactful project execution.

2. Improve supplier selection

Enhancing supplier selection is crucial for maintaining profitability and gaining a competitive edge in business, especially within the construction procurement landscape. A robust procurement strategy hinges on optimizing the supply chain performance. Our experts specialize in guiding construction procurement businesses through a meticulous supplier selection process, leveraging multiple criteria tailored to specific verticals. By assessing construction timeline, procurement methods, and procurement process, we identify tier-1 suppliers aligned with client-defined key performance indicators (KPIs). These KPIs encompass vital metrics such as total cost of ownership (TCO), reliability, timeliness, compliance rate, and more. This ensures that suppliers selected not only meet project requirements but also contribute to overall business success.

Whether it’s for a major construction project or construction management procurement, we provide comprehensive support in project procurement management. Our expertise extends to developing detailed construction management plans and optimizing construction procurement schedules using advanced construction management software. Enhancing supplier selection is crucial for maintaining profitability and gaining a competitive edge in business, especially within the construction procurement landscape. A robust procurement strategy hinges on optimizing the supply chain performance. Our experts specialize in guiding construction procurement businesses through a meticulous supplier selection process, leveraging multiple criteria tailored to specific verticals.

3. Supplier selection- a detailed guide

By assessing construction timeline, procurement methods, and procurement process, we identify tier-1 suppliers aligned with client-defined key performance indicators (KPIs). These KPIs encompass vital metrics such as total cost of ownership (TCO), reliability, timeliness, compliance rate, and more. This ensures that suppliers selected not only meet project requirements but also contribute to overall business success. Whether it’s for a major construction project or construction management procurement, we provide comprehensive support in project procurement management. Our expertise extends to developing detailed construction management plans and optimizing construction procurement schedules using advanced construction management software.

Through a collaborative approach with construction managers, we formulate a tailored procurement management plan that aligns with project objectives and enhances operational efficiency. By improving supplier selection processes and fostering strategic partnerships, businesses can drive success in the competitive construction industry landscape.

4. Enhance fulfillment efficiencies in construction procurement

Lack of visibility and communication across the supply chain breeds inefficiencies that weigh down construction procurement teams from giving their best. Procurement organizations also risk losing control over their sourcing environments. At SpendEdge, we offer bespoke solutions designed to help clients gain transparency on specific commodities and ensure they are able to reduce any potential bottlenecks.

Success story: A procurement organization in the US steel industry improves budgeting and forecasting accuracy

Our client is a mid-size manufacturer of stainless steel coils and strips based in the US. The oil and gas industry is a major end-use client for steel coils. These find application in pipes, valves, and other equipment, thanks to their capacity to withstand corrosion damage and excessive heat and pressure. These physical properties are shared by the client’s stainless steel strips as well, and these are used in various automotive and aerospace parts. Besides oil and gas, automotive, and aviation, our client services sectors such as food and beverage, pharma, and home and kitchen appliances with a range of customized offerings.

While the client is poised for robust growth, there are some inescapable demand headwinds such as limited buying activities in certain markets. Lowered capacity utilizations (of 65-70%) for the steel industry at large is also an important constraint. In view of these warning signs on its dashboard, the client desired to quantify and predict construction procurement costs more accurately as a top priority. The client also required some assistance to plan for potential volatilities in the supply chain. After careful due diligence, the company started working with our sourcing experts to straighten out the tangles in the construction procurement workflow.

With more than two decades of experience in breaking down construction procurement metrics to derive accurate insights, our specialists, working in tandem with client teams, identified a few large “clusters” responsible for a disproportionately higher share of the client’s sourcing spend. Therefore, some critical areas in procurement remained starved of money and resources!

Armed with this insight, the client’s procurement organization is working on ways to fine-tune supply-side costs by renegotiating better terms with existing suppliers. Suffice it to say, they are reimaging what is construction procurement as we know it. The steel business is also surveying the landscape for more efficient suppliers.

The impact on the bottom lines of whimsical rises in material costs is far worse than is imagined. Expanding the supplier network vigorously and renegotiating more winning deals with the supply side will help the client beat the heat of volatility. In fact, this was one of the highlights of our study. The client is going about this seriously and determinedly.

Deep, accurate, and relevant data on supplier costs, uncovered by our study, will also inform the client’s budgeting for the next year, leading to more positive financial outcomes in the mid-to-long term. Early feedback from the client on our procurement methods for construction is very encouraging.

Contact us now to solve your procurement problems!

Conclusion

Effective construction procurement is essential for success in the construction industry. Collaborating with construction industry pros and the procurement team, businesses can optimize construction project costs and streamline construction procurement processes. Utilizing advanced procurement technology, organizations can drive efficiency in construction project procurement for major construction projects. By developing a Strategic Procurement Plan and prioritizing construction timeline, stakeholders can maximize success in construction management. Strategic contracting with the right suppliers ensures quality work and compliance, fostering sustainable growth in the construction industry.

Author’s Details

Arthi

Associate Vice President, Sourcing and Procurement Intelligence

Arthi is an Associate Vice-President with Infiniti Research. She leads one of the procurement intelligence groups within the organization supporting global pharma, life sciences and FMCG companies by proving data-driven procurement insights.