Commodity price monitoring is unavoidable for businesses keen on optimizing prices to drive sales. Our COMET platform provides at-a-glance updates on commodity prices, with over “250 prices series” histories and forecasts.

Prediction accuracy can make or break a commodity trader’s dreams. Thanks to the directional accuracy of COMET’s forecasting framework, our clients are able to hedge themselves against inflation.

Generating price forecasts for limited durations is tricky but doable. Leveraging augmented AI, we generate reliable insights (92% absolute accuracy) that decision-makers can action with high confidence across even 90-day timeframes.

Accuracy is the biggest casualty in price forecasting

There is skepticism about the validity of commodity price predictions premised solely on past events and to the exclusion of other variables.

A multivariate model can forecast outcomes better

Businesses hunger for best-in-class accuracy in their price forecasts with a range of possible variables factored in. Our forecasting framework is predicated on a multivariable model, besides historical trends of individual commodities and a curated database. As a result, our clients benefit from a continuous stream of precise competitive market insights.

In the medium-to-long-term, prices tend to defy predictions

Many commodity trackers get their short-term forecasts right, but predictions for longer timeframes are almost always off the mark, miffing users.

The short answer is “Maximize your data on price drivers”

Making accurate price estimates for the longer term is entirely feasible so long as the forecasting engine is using broad-based data, covering the swathe of factors that drive commodity prices. Our COMET platform draws on price data for over “250 price series” histories and forecasts, providing maximum insight into price-driving factors.

Outlier events often trump traditional predictive models

The biggest inadequacy of conventional commodity price forecasting models is that they are not necessarily prepared for black swan events.

There is a need to continually reset the forecasting configuration

While no model is omniscient, it is crucial that forecasting algorithms are retrained on fresh datasets and events (weather, tariffs) to improve forecast accuracy. The forecasting algorithms we use are dependent not just on macroeconomic factors but also on broader parameters to prepare traders for random and unexpected events (“black swans”).

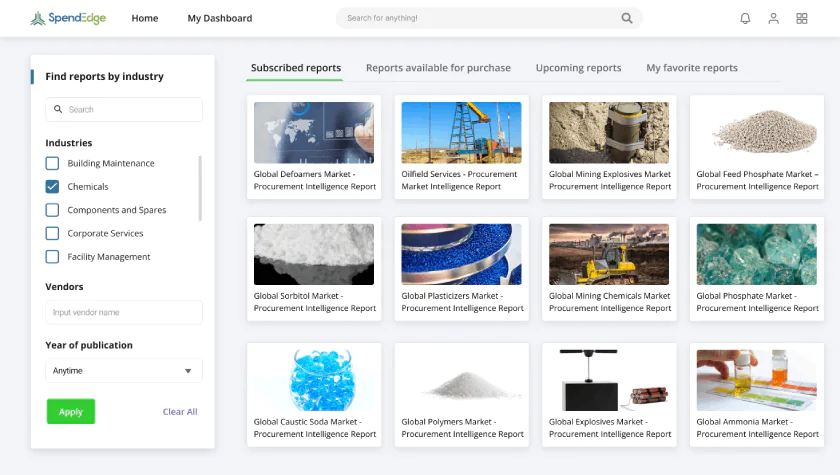

Data is everywhere, but just where is relevant and actionable data? With SpendEdge Insights, you have instant access to 800+ categories and subcategories, so you can unlock deep intelligence about your products and your competitors’.

Read more Know about SpendEdge Procurement Market Intelligence Space

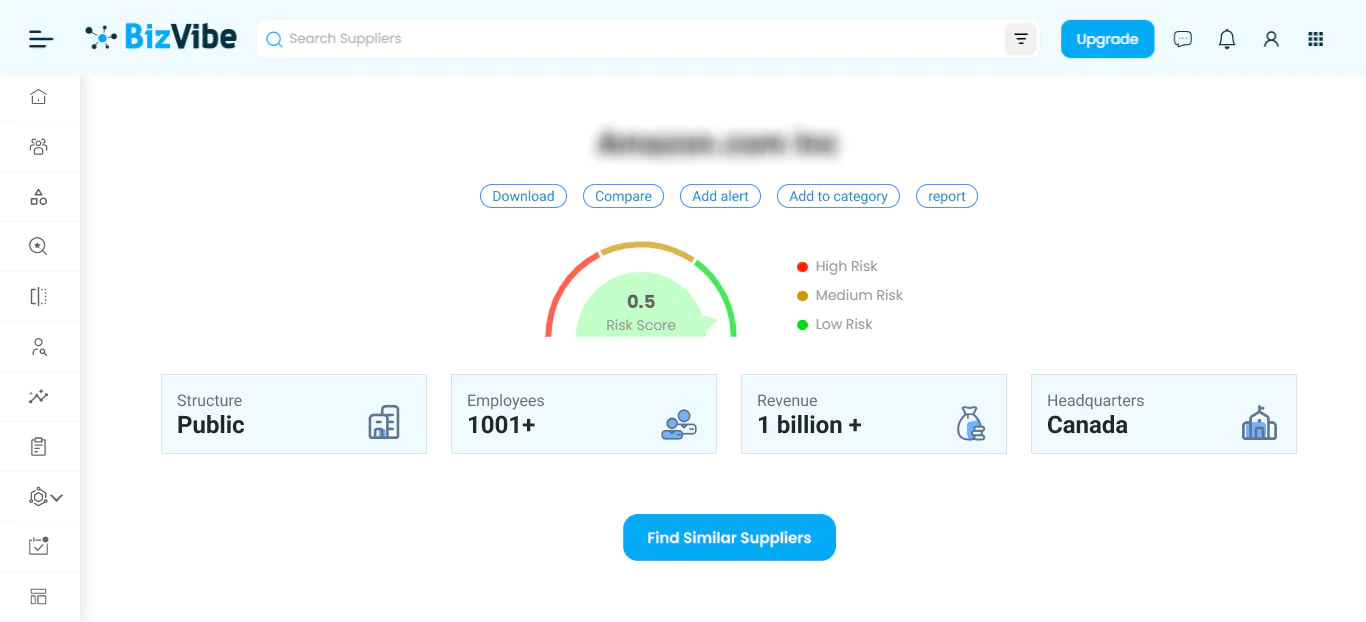

Supplier data points are all over the Internet, leaving users confused. With BizVibe, your business can enjoy instant access to millions of relevant supplier profiles and shortlist the best ones.

Read more Know about SpendEdge Procurement Market Intelligence Space

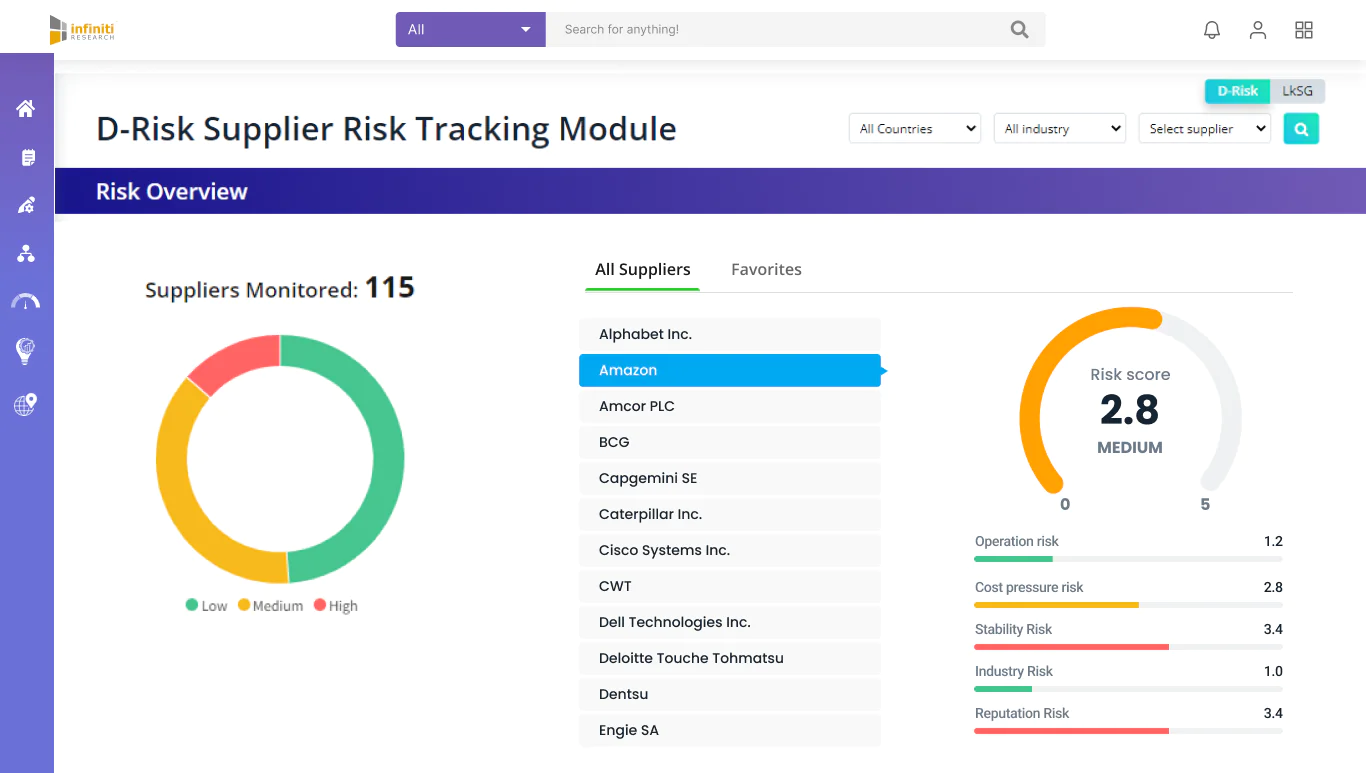

Fines and reputational losses arising out of unplanned supply outages are nothing short of damning! D-Risk keeps supplier issues at bay by generating risk scores for all your top vendors.

Read more Know about SpendEdge Procurement Market Intelligence Space

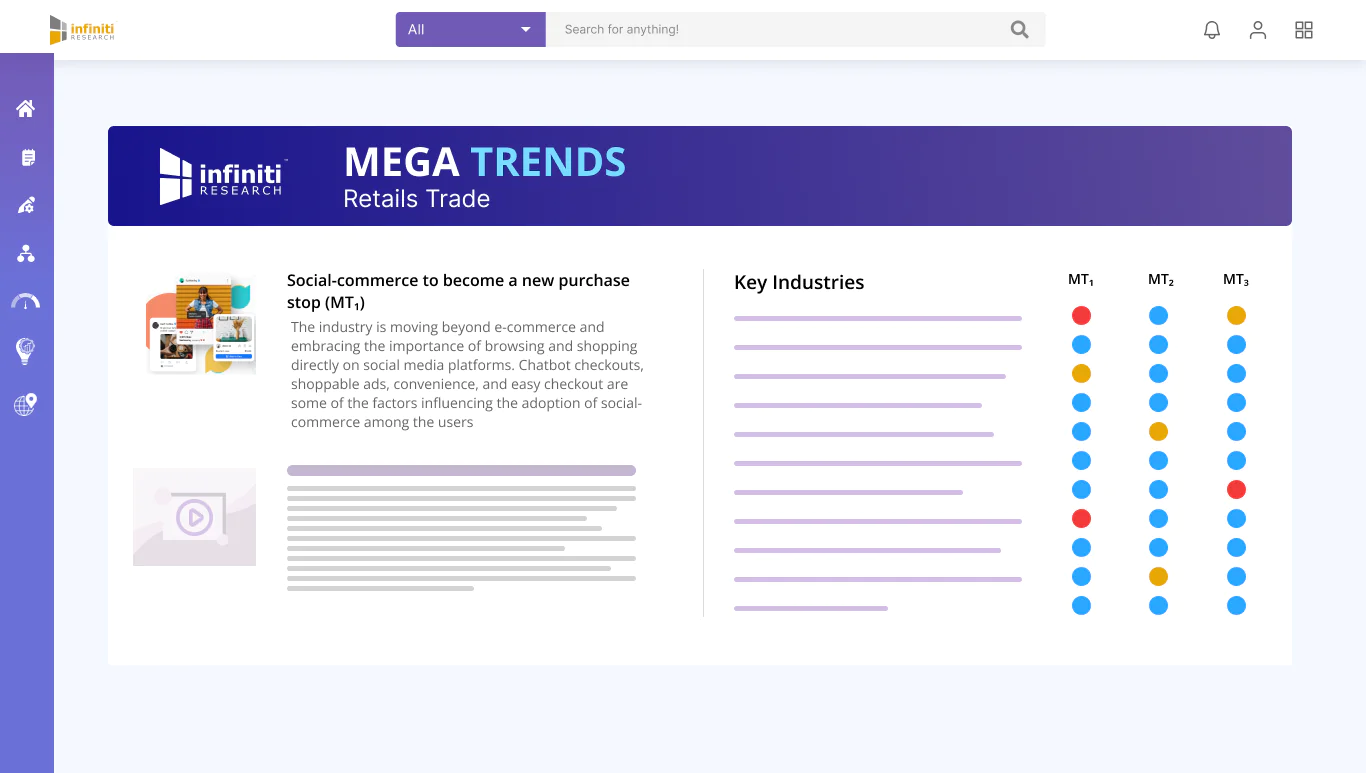

Making procurement decisions without factoring in events from across industries is a recipe for disaster. Enter Mega Trends, a tool that keeps you posted on key trends from multiple industries.

Read more Know about SpendEdge Procurement Market Intelligence Space

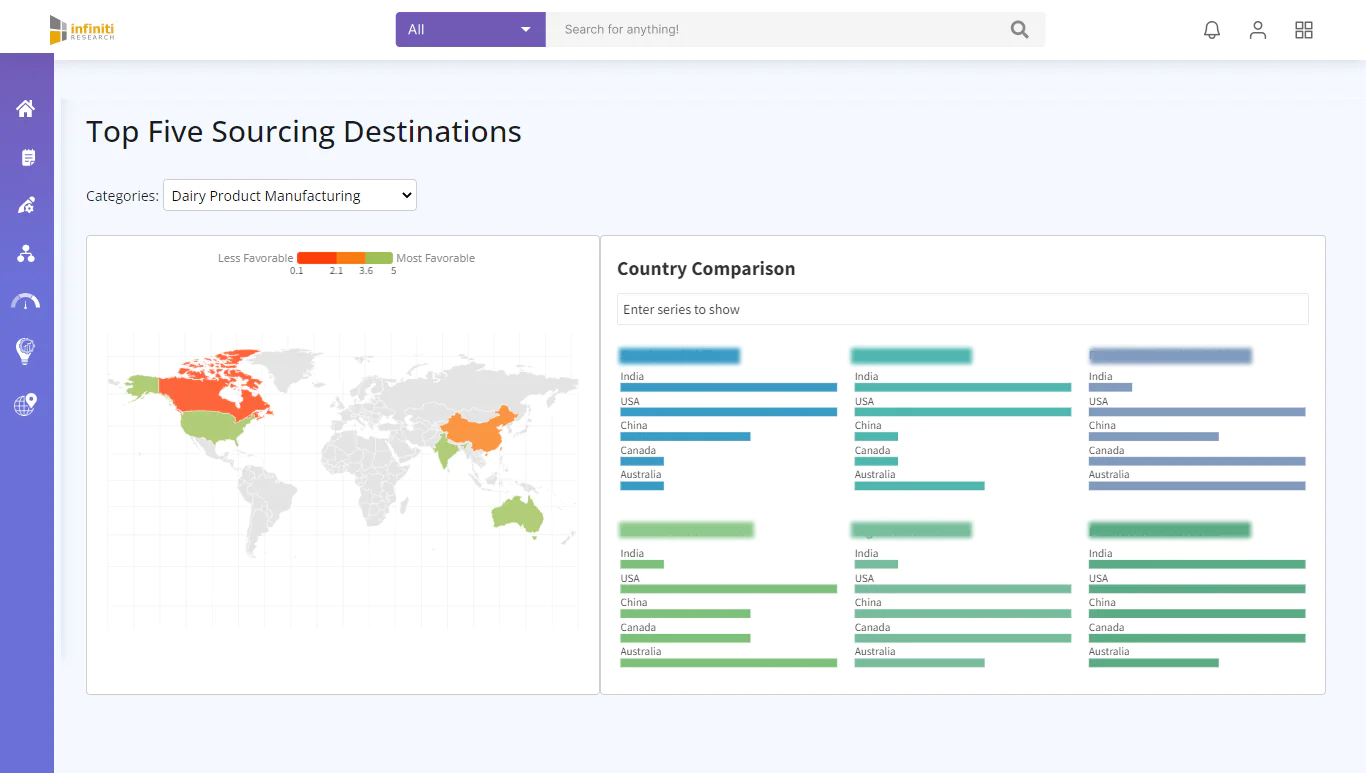

To derive any real value from “country market” sourcing, you need to understand these destinations in-depth. Our granular insights will help you to tap into various country markets profitably.

Read more Know about SpendEdge Procurement Market Intelligence Space

Not all trackers are premised on broad-based datasets, so forecasting accuracy proves elusive. What are the features to look for in a tracker?

Talk to Our Expert to see the spendedge blogs

Challenge: Faced with intense competition and the need to improve profit margins, our client turned to SpendEdge for assistance in overcoming their business challenges. One of the main strategies involved migrating cost-intensive operations to low-cost destinations.

Solution: Our team at SpendEdge assisted the client in streamlining their contract manufacturer selection process. Leveraging our expertise and market research methodology, we identified key contract manufacturers for the client’s ready-to-eat product line.

Result: The client successfully addressed their business challenges and achieved improved profit margins and reduced operating costs. All the while, also enhancing product quality and expanding manufacturing capabilities.

Read More to see the spendedge blogs