Key Takeaways

- Economic Impact: The banking sector faces ongoing profitability challenges from past economic downturns.

- Strategic Procurement: Essential for competitive edge and achieving goals through cost-effective acquisitions.

- Digital Tools: Improve cost-to-income ratios and efficiency with digital procurement tools and automated channels.

- Spend Optimization: Control costs and maintain financial health using spend analysis and should-cost modeling.

- Innovative Partnerships: Collaborate with fintech companies and neobanks for innovation and cost savings.

- Regulatory Compliance: Adherence to regulatory requirements is crucial for operational integrity.

- Support Core Functions: Efficient procurement supports key banking functions like mortgage applications.

- Resource Management: Ensures budget holders have necessary resources while maintaining fiscal discipline.

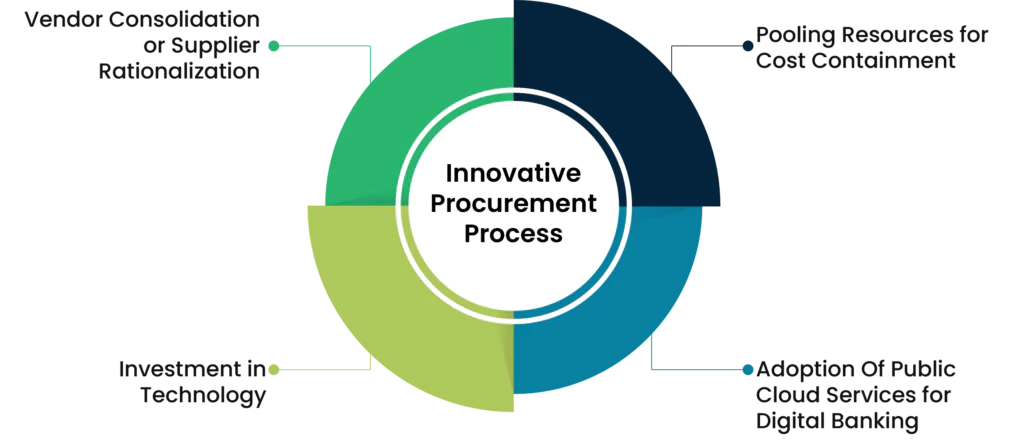

- Cost Containment: Strategies like pooling resources, vendor consolidation, and technology investment reduce costs.

- Future Trends: Embracing blockchain and public cloud services enhances procurement efficiency.

The banking sector is still affected by the great depression witnessed a decade back. Numerous procurement cost including real estate, ATM maintenance, transaction and card processing services, collections, risk management, security services, and in-branch marketing are burdening the banks bringing down their profitability. To remain competitive and sustain in the market banks and financial institutions are looking for various cost containment strategies. The banking sector is looking for innovative ways in their procurement process to control the procurement costs.

Source: SpendEdge Procurement Research Report – Global Banking Services Category

What Is Banking procurement and Why Is It Important?

In today’s fast-paced world, banking institutions face a growing challenge to stay competitive while ensuring the highest levels of customer satisfaction. One way to achieve this is through effective procurement strategies that ensure timely and cost-effective acquisition of goods and services. But what exactly is procurement in banking, and why does it matter? In this blog post, we’ll explore the importance of procurement in banking operations and how it can help banks achieve their strategic goals efficiently.

Banking procurement refers to the systematic process of sourcing and acquiring the necessary goods, services, and technology to support the bank’s operations. The procurement department plays a pivotal role in this process, ensuring that purchases are made efficiently and in compliance with regulatory requirements.

Digital procurement tools have revolutionized the way banks manage their procurement activities. These tools facilitate automated buying channels, allowing for quicker and more accurate purchasing decisions. By leveraging these tools, banks can significantly improve their cost-to-income ratios, ensuring better financial performance. Effective procurement involves a thorough understanding of spend areas, allowing banks to identify where money is being spent and how to optimize these expenditures. This strategic approach often includes the use of should-cost modeling to predict and control costs, enhancing overall financial efficiency. Collaboration with fintech companies and neobanks can further drive innovation and cost savings in the procurement process. These partnerships can provide access to cutting-edge technologies and solutions that traditional banks may lack, improving service delivery and operational efficiency.

In the realm of finance, procurement is crucial for supporting core banking functions such as mortgage applications. Ensuring that the necessary services and technologies are procured efficiently can streamline these processes, leading to higher customer satisfaction and better financial outcomes. Budget holders within the bank rely on the procurement department to provide the tools and resources they need while staying within budget constraints. This alignment is essential for maintaining a healthy balance sheet and achieving the bank’s financial goals. Effective procurement in banking is integral to maintaining a competitive edge, ensuring compliance, and optimizing operational costs. By employing digital procurement tools and automated buying channels, banks can enhance their cost-to-income ratios and support strategic spend management. Collaboration with fintech companies and neobanks can further boost innovation and efficiency, ultimately supporting the bank’s financial health and strategic objectives.

Pooling Resources for Cost Containment

The banks and financial service providers have come up with innovative solutions to pooling of resources for a particular line of business, allocating a dedicated entity to manage the processing. Pooling of resources to share infrastructure and operational costs across the organizations can lead to massive cost savings and at the same time increase the investment efficiency by making capital-intensive projects more viable.

Vendor Consolidation or Supplier Rationalization

Vendor consolidation is one of the procurement strategy used by banking and financial services industry to achieve cost savings. Banks look forward to reducing the number vendors across geographies and business units to focus on selecting preferred vendor per spend category. Implementing such vendor partnerships allow banks to increase their operational efficiency and productivity and thereby save valuable time and money. Additionally, such procurement cost reduction strategies eliminate the need for lengthy training procedures for the staff and also ensure compliance with the procurement process.

Investment in Technology

The financial industry has always been resource intensive and over-reliant on human expertise. Although the majority of the banks invest heavily in ERP systems, the usage of technology is still limited mostly due to lack of people who understand such technology. Blockchain technology is the next big thing in the financial services industry which can eliminate lengthy transaction processes along with costly third-party verification. Such technologies can rapidly increase the efficiency of the procurement process within the financial industry.

Adoption Of Public Cloud Services for Digital Banking

Banking service providers are turning towards applications and storage space available in the public cloud eliminating the need to invest in dedicated hardware and software resources. Opting for various engagement models such as SaaS, PaaS, and IaaS, banks can digitize their services without having to maintain data centers.

What are cost-saving strategies in banking procurement

Supplier Negotiations and Consolidation:

Banking institutions can achieve significant cost savings by negotiating better terms and conditions with their suppliers. By leveraging their purchasing volume and consolidating procurement efforts, banks can negotiate lower prices, improved payment terms, and reduced service fees. This approach can be particularly effective for commonly purchased goods and services, such as office supplies, IT equipment, or facility maintenance services. Strategic supplier management and partnerships can lead to long-term cost reductions.

Technology and Automation:

Implementing technology and automation solutions in the procurement process can streamline operations and reduce costs. Procurement automation tools, such as e-procurement systems and e-sourcing platforms, can help banks optimize supplier selection, purchase order processing, and invoice management. By automating routine tasks and reducing manual intervention, banking institutions can not only save time but also minimize errors and improve compliance with procurement policies, ultimately leading to cost savings.

Supplier Performance Evaluation:

Regularly evaluating supplier performance is essential to identify underperforming vendors and assess the quality of goods and services provided. Banking institutions can use key performance indicators (KPIs) to measure supplier performance in terms of cost-effectiveness, quality, and delivery timeliness. By holding suppliers accountable and maintaining transparency in the procurement process, banks can drive suppliers to continuously improve their services and, if necessary, replace underperforming vendors with more cost-effective alternatives.

Read more about the procurement process in the banking services market along with pricing strategies, supply market landscape, pricing trends, negotiation strategies, procurement cost reduction strategies, and procurement insights in SpendEdge’s upcoming report on the global banking services market.

Conclusion

The evolving banking sector must prioritize effective procurement strategies to remain competitive and ensure customer satisfaction. Leveraging digital procurement tools and automated buying channels can significantly improve cost-to-income ratios and enhance operational efficiency. Understanding and optimizing spend areas through methods like should-cost modeling is crucial for cost control and financial health. Collaborations with fintech companies and neobanks introduce innovation and cost savings, while compliance with regulatory requirements remains paramount. The procurement department plays a vital role in supporting core banking functions, including mortgage applications, by ensuring efficient service procurement. Budget holders rely on the procurement team to provide necessary resources while maintaining fiscal discipline, which is essential for a healthy balance sheet. By adopting these strategies, banks can achieve their strategic goals, enhance customer satisfaction, and secure a robust position in the competitive financial landscape.