Virtual cards, in comparison to physical company cards, offer versatility in corporate activities such as planning events, booking travel, and boosting employee engagement. They surpass traditional cards with features like preapproved spend, enhancing compliance by generating cards only after approval. Additionally, virtual cards excel in fraud prevention with defined valid days, set spend limits, and increased security, making them advantageous for various organizational needs.

In the Procure-to-Pay (P2P) ecosystem, virtual cards demonstrate their value through diverse use cases. For one-time suppliers, they eliminate the tedious onboarding process by providing one-time virtual card details. Virtual cards also prove valuable for deposits, facilitating upfront payments for corporate events or fringe benefits. Travel expenses can be pre-approved, preventing overspending, and recurring bills are efficiently managed with coding set on a regular cadence.

The benefits of virtual cards extend beyond use cases, encompassing crucial advantages for businesses. They play a pivotal role in preventing employee fraud, addressing the significant issue of inflated reimbursement claims. Virtual cards mitigate enterprise risk by generating unique, temporary card details that inactivate after approved charges. Furthermore, they enforce compliance with spending and purchasing policies by pre-setting limits, eliminating the risk of overcharging. Virtual cards, differing from their physical counterparts, offer a broad spectrum of utility in corporate spheres, ranging from event planning and travel booking to employee engagement initiatives and team-building endeavors.

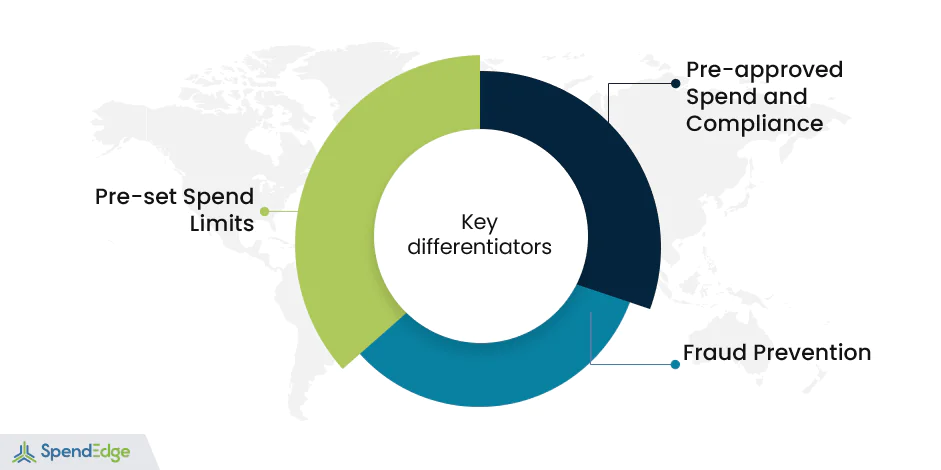

What sets virtual cards apart is their proactive approach to financial management:

- Preapproved Spend and Compliance: Virtual cards take a strategic stance by generating only after a spending request gains approval. This process ensures that requisite authorizations are secured before the card is created, enhancing compliance from the outset.

- Fraud Prevention: A distinctive feature of virtual cards lies in their predefined validity period, minimizing vulnerability to theft and preventing the unauthorized circulation of crucial card details. This inherently strengthens the security of transactions.

- Pre-set Spend Limits: Virtual cards come equipped with predetermined spending limits, guarding against overcharging by suppliers or employees. This feature enhances financial control, ensuring adherence to budgetary constraints.

These advantages position virtual cards as versatile and indispensable tools for organizations across diverse industries.

Use Cases for Virtual Cards within the Procure-to-Pay (P2P) Ecosystem:

- One-time Suppliers: Simplifying a traditionally cumbersome process, virtual cards eliminate the need for extensive supplier onboarding for one-time transactions. By providing suppliers with one-time virtual card details, the procurement cycle becomes more streamlined.

- Deposits: Whether for corporate retreats, team events, or employee benefits, virtual cards offer a swift and secure method for upfront payments. This is particularly beneficial when compared to the time-consuming settlement period associated with traditional payment methods like ACH, NEFT, GIRO etc.

- Travel and Trips: Shifting the paradigm from post-purchase expense reporting, virtual cards enable pre-approval for employee business travel. This ensures that expenditures align with predetermined budgets.

- Recurring Bills: Managing regular payments, such as electricity, phone/internet, and utility bills, is simplified with virtual cards. The automation of coding on a regular cadence streamlines the process and ensures timely payments.

Five Benefits of Virtual Cards:

- Prevent Employee Fraud: Virtual cards play a crucial role in mitigating the risk of employee expense reimbursement fraud. By automatically matching transactions to pre-defined parameters, including dollar range, supplier, and date, they significantly reduce the likelihood of fraudulent activities.

- Limit Enterprise Risk: The unique 16-digit number, expiration date, and CVV generated by virtual cards become inactive after the approved value is charged, minimizing concerns about corporate card information falling into the wrong hands.

- Enforce Spend and Purchasing Policy Compliance: By establishing preset spending limits, virtual cards promote adherence to procurement policies, eliminating the erstwhile “blank check” scenario. This proactive approach ensures that spending aligns with organizational guidelines.

- Free Up Cash Flow and Bring on Savings: The “buy now, pay later” policy facilitated by virtual cards contributes to increased Days Payable Outstanding (DPO), providing businesses with improved cash flow management.

- Rebates: Virtual card programs offer the added benefit of earning rebates, transforming departments from mere cost centers into revenue-generating entities.

Keys to Implementing a Successful Virtual Card Program:

Initiating a virtual card program involves deploying technology, such as a Business Spend Management (BSM) solution and establishing agreements with preferred banks. Key steps include:

- Select a Compatible BSM Application: Choose an application that seamlessly integrates with bank and card providers. This integration ensures a user-friendly purchasing process, crucial for widespread adoption.

- Define Categories and Suppliers Eligible for Virtual Card Use: Conduct a spend analysis to identify suitable categories for virtual card use. Not all suppliers accept credit card payments, so a targeted analysis aids in pinpointing eligible areas.

- Drive Accountability and Compliance: Regularly follow up with stakeholders not utilizing virtual cards, leveraging reporting tools provided by BSM applications like Coupa. This ensures adherence to procurement policies and encourages virtual card usage where stipulated.

- Practice Reconciliation During Roll-out: To ensure smooth integration, practice reconciliation before full-scale implementation. Integrating bank statements directly into the system, as facilitated by applications like Coupa, streamlines the monthly reconciliation process.

In essence, virtual cards emerge as dynamic tools, revolutionizing corporate financial transactions and procurement processes through their advanced features and multifaceted benefits across diverse business functions. Their proactive and secure nature positions them as indispensable assets in the evolving landscape of corporate financial management.