The snowballing of legal guidelines has businesses scurrying for market intelligence to meet compliance mandates.

Money laundering is a serious offense, so failure to clear the air around contentious transactions has implications for banks.

Banks use third-party tools, including for cybersecurity. Ironically, criminals are slipping malicious codes into such trusted platforms to compromise banks!

Amid global crises fears, the sector must chase new opportunities to maintain growth momentum without losing sight of compliance commitments.

A siloed perspective on data is a key factor holding financial institutions from reaching full fruition and exceeding customer expectations.

A sector whose margins are under pressure, a phenomenon attributable to changing risk exposures, must explore creative ways to pare costs.

An indomitable spirit and a laser focus on digitalization and data security is what is paying off in the financial sector. Our BFSI specialists will prep you for the big leap in digital technology and bolster your cyber perimeter to reduce costs and improve bottom lines. Plus, we ensure you don’t miss out on any compliance mandate.

Talk to Our Expert

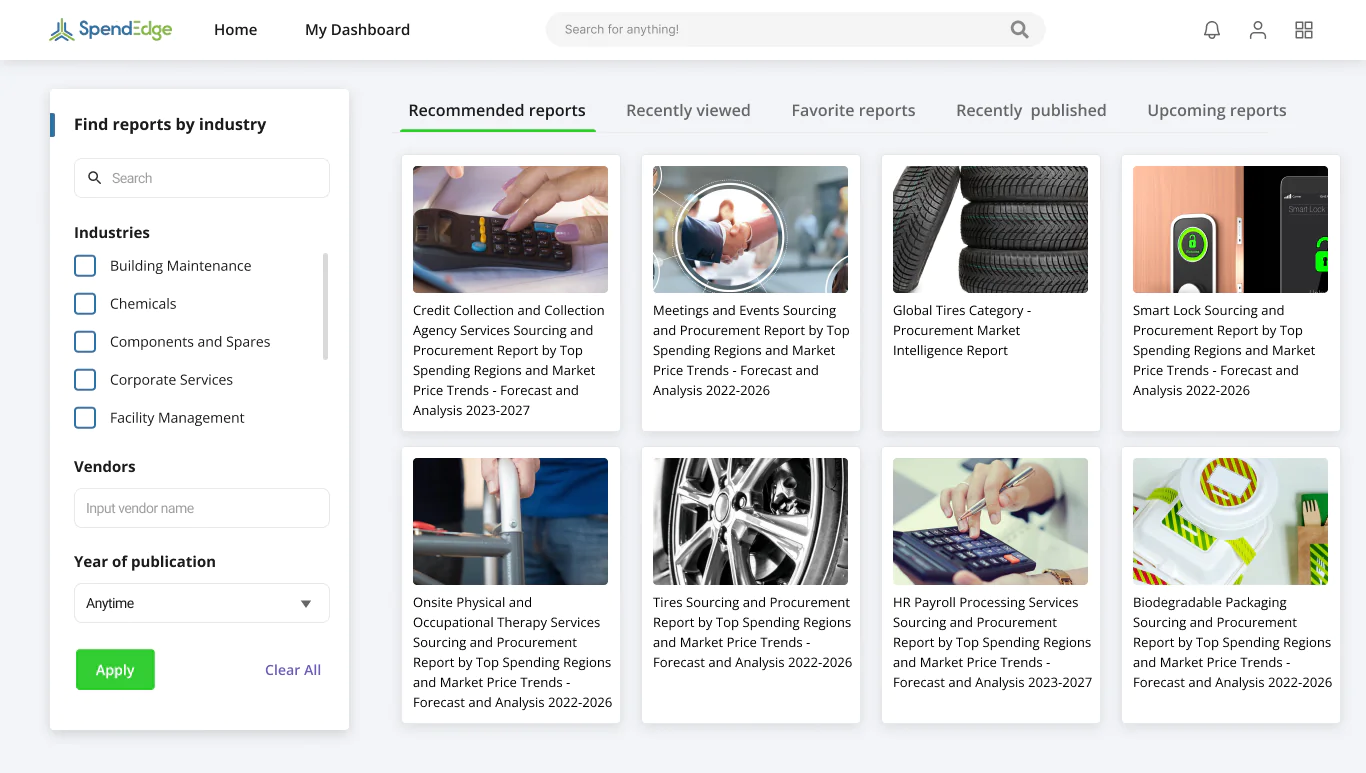

In today's rapidly evolving financial services landscape, organizations face increasing pressure to optimize their supplier relationships. A leading market intelligence company partnered with a prominent financial services provider to enhance their supplier benchmarking process. This collaboration aimed to establish a systematic approach for evaluating suppliers based on critical performance metrics....

Read More to see the spendedge blogsGathering data on your supplier’s capability to deliver high-quality products is just not enough. More open communication will ensure suppliers not only deliver with quality but also ahead of schedule.

Supplier failures could become a double whammy for any business. There is revenue loss, plus reputational risk! Identifying contractors based on strong data points is key to mitigating partner risks. Get our market reports and be the first to know about supply risks.